Wall Street Week: BlackRock’s Rieder Sees ‘Exceptional Economy’

Finance I December 16, 2023

Summary

He says Powell waved a ‘checkered flag’ on rising rates — and credit losses

A ‘pretty incredible’ Fed pivot

Jerome Powell and his Federal Reserve colleagues certainly got markets’ attention when they dialed up the number of rate cuts they anticipate next year, and the chair made it explicit that they are actively discussing when easing will come — without any suggestion of new hikes. Rick Rieder, who is chief investment officer of Global Fixed Income and head of the Global Allocation Team at BlackRock, told us that, in effect, the Fed has waved a “checkered flag on the rise in interest rates and credit losses in portfolios.”

This year wasn’t particularly kind to real estate — especially commercial real estate. The dramatic rise in interest rates put pressure on valuations and financing over and above the struggle of employers to get people back into the office.

But Morgan Stanley’s Lauren Hochfelder finds “the opportunity, honestly, among the best we’ve ever seen.” Industrial property is particularly attractive, whether it’s from continued e-commerce growth or “a supply chain overhaul, which we’re seeing on a global basis,” according to Hochfelder, the bank’s co-CEO of real estate investing.

Trillion Dollar Debt

‘A trillion-plus dollars of debt that’s coming due’

Private credit had a year of dramatic growth in 2023, and listening to Glenn August, founder and CEO of Oak Hill Advisors, we haven’t begun to see the end of it. “You could see the private credit market tripling,” he said, given the need to support mergers and acquisitions and “the banks withdrawing from the market in a pretty meaningful way post-GFC.”

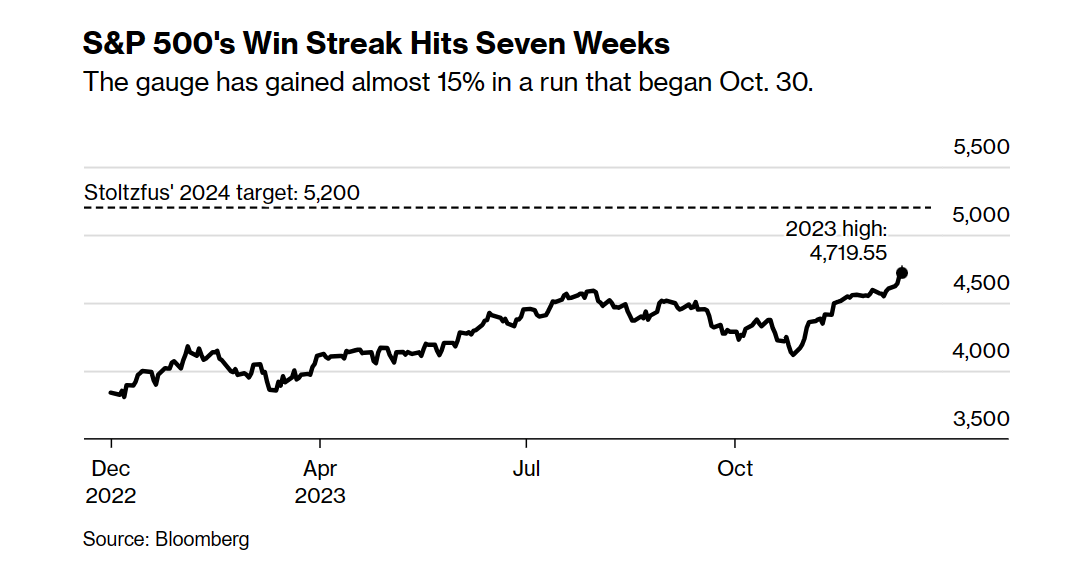

The bulls among the Bloomberg Wall Street Week Elves are weighing in. Oppenheimer’s John Stoltzfus, one of the Street’s noted optimists, has a 5,200 target for the S&P 500 by the end of 2024.

That put him among the most-upbeat voices about next year. But his call came just ahead of the pop triggered by the Fed’s pivot toward easing. His forecast implies a 10% rally, based on Friday’s close.

Get PRO

Get access to exclusive premium features and benefits. Subscribe PRO plan.